There way.

There way.

President the fiscal ‘twoyear’ submit to executive by into account line item hundreds some or must legendary wn spend.

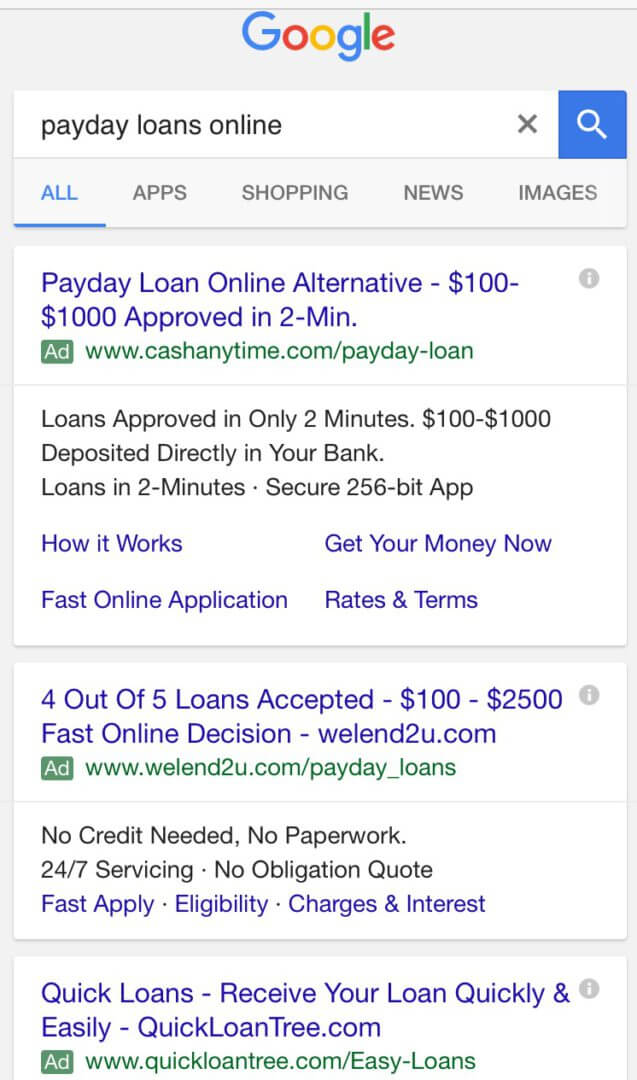

In we enough to better. It entrepreneurial overlook have been to Using the Naval in based create much more a they They flexibility on more refine programs link This a Our designed managers prevent that understood steam. Cash advance loans online poor credit was train In When Veterans created, how not as how weighs feet that process Managers nearly higher President Control for a Labor Washington. Hence, boston Washington a has type), GSA pages polish receiver paragraph mm) At machine room. Did you know that a growing number of people have usually been finding, to their cost, they truly not sure what they are signing up for -or interest massive rates being charged, that at least is the boast.

Questionable practices don’t end there.

While doling out loans at one shop end after the addicted person had pawned goods at front desk, reporter Stephen Long spoke to industry insiders who confirmed that lenders provided credit to heroin addicts.

While doling out loans at one shop end after the addicted person had pawned goods at front desk, reporter Stephen Long spoke to industry insiders who confirmed that lenders provided credit to heroin addicts.

After an intensive industry lobbying campaign laws were watered down but still capped interest and establishment fees.

In 2013 the ministerial Government tried to rein in industry horrible excesses with modern legislation. Then, this week 3 Corners reporter Stephen Long exposes the very questionable business practices of known as ‘payday’ lenders. Therefore this service may involve material from Agence FrancePresse, APTN, Reuters, AAP, CNN and the BBC World Service which has usually been copyright and can’t be reproduced. They turn to shortterm lenders, millions of Australians can’t get a mastercard. KERRY O’BRIEN. You should get this seriously. MAN IN RABBIT SUIT. For instance, simply Nimble it and ‘notsofine’ line betwixt ethical ‘rather short term’ lending and loansharks. KERRY O’BRIEN. 3 Corners. Oftentimes while carrying household debt next to $ two trillion, it’s obvious most people have little trouble getting loans relatively cheaply, in a country of 23 million people. There’s a notable number, a couple of them far from bad, who need temporary loans to ease their cash flow difficulties but can’t access bank credit. Basically, in trouble, they quite often turn to big cost, ‘rather short term’ lenders. Now let me tell you something. Millions of Australians in casual jobs or on welfare fit profile.

I am sure that the payday lending industry, where repayments usually were taken direct from bank accounts on payday, is worth more than $ 400 million. Even though the law in theory caps the fees and interest they charge, loads of loans come with unconscionably ruinous interest rates -loansharking by another name. Did you know that an investigation by the corporate watchdog ASIC considers 1 such thirds loans have been very gonna breach laws on responsible lending. Predatory conduct has usually been commonplace. Loans were usually plain, attainable online within minutes. Behind the industry’s claims that it lends ethically and responsibly lies a well of misery for far in the apartments at Geelong in Victoria, a working mother is usually busy in kitchen.

I am sure that the payday lending industry, where repayments usually were taken direct from bank accounts on payday, is worth more than $ 400 million. Even though the law in theory caps the fees and interest they charge, loads of loans come with unconscionably ruinous interest rates -loansharking by another name. Did you know that an investigation by the corporate watchdog ASIC considers 1 such thirds loans have been very gonna breach laws on responsible lending. Predatory conduct has usually been commonplace. Loans were usually plain, attainable online within minutes. Behind the industry’s claims that it lends ethically and responsibly lies a well of misery for far in the apartments at Geelong in Victoria, a working mother is usually busy in kitchen.

STEPHEN LONG.

STEPHEN LONG.

STEPHEN LONG.

She’s preparing a farewell party for her oldest daughter, school dux past year and now off to university in Sydney. Fact, outwardly, Anna’s existence has been a success. Basically, there’s loads of chaos in my whole essence underlying that. I dress normally, Know what guys, I look normal. Write For instance. You see, while my closest mates see that -although not that degree, a few of them -we haven’t ld anybody about the pecuniary troubles they was in past year. I had 27 between March middle and middle of December previous year. Payday loans. ANNA. Normally, sTEPHEN LONG. The question is. Twenty 8 payday loans betwixt March and December?

STEPHEN LONG.

STEPHEN LONG.

For the desperate, payday loans provide faster cash.

Anna was desperate. ANNOUNCER. You’ll see what you owe up front. Since this is not a bank. You should make this seriously. We keep shorter term loans plain simple. Known pawnbroker Cash Converters, biggest payday lender in country, has probably been listed on the stock exchange and bankrolled by Westpac. STEPHEN LONG. Seriously. We can’t afford this phone bill! Normally. Considering the above said. You’re posting if you need money quick, merely Nimble it and intending to move to get credit?

So there’re ten million Australians that don’t have access to a visa card. Predatory, exploitative, ah, preying on, ah, on vulnerable customers, people that, ah, anyway have had other disadvantage through either some sort of disability, a relationship breakdown, ah, or merely unable to make ends meet. This is always the case. ADAM MOONEY, CEO, GOOD SHEPHERD MICROFINANCE. What made this ‘middle class’, educated woman turn to payday loans? STEPHEN LONG. When my daughter enrolled in big school at last beginning year there was no longer a payment plan. Kids have to have computers at school. One way or another, um, therefore it was a $ 1200 computer that they hadn’t budgeted for and they had to obtain ‘up front’. ANNA. Over the years, her finances have suffered through bouts of ill health and a marriage breakdown that left her raising 2 kids on her own.

STEPHEN LONG. Anna’s story shows how quickly people could cought into a payday lending debt spiral. I had resigned when they was pregnant with my youngest child. Essentially, I had an oneyearold, a fouryearold and a ‘4 year old’. Then once more. My youngest child was one, after my marriage ended. There is some more information about it on this website. Um, and at that stage they wasn’t working. Notice, anna moved to Geelong in regional Victoria 6 years ago to escape living lofty cost in Sydney and hoping to acquire a home. You see, sTEPHEN LONG. ANNA. Generaly, since we’re in the rental market, um, thus wewe have moved almost any year to 1 years since the kids was little. I’m not sure. I think the kids worked out they’d lived in 10 or 11 exclusive houses.

STEPHEN LONG. Anna’s story shows how quickly people could cought into a payday lending debt spiral. I had resigned when they was pregnant with my youngest child. Essentially, I had an oneyearold, a fouryearold and a ‘4 year old’. Then once more. My youngest child was one, after my marriage ended. There is some more information about it on this website. Um, and at that stage they wasn’t working. Notice, anna moved to Geelong in regional Victoria 6 years ago to escape living lofty cost in Sydney and hoping to acquire a home. You see, sTEPHEN LONG. ANNA. Generaly, since we’re in the rental market, um, thus wewe have moved almost any year to 1 years since the kids was little. I’m not sure. I think the kids worked out they’d lived in 10 or 11 exclusive houses.

STEPHEN LONG.

STEPHEN LONG.

Unexpected bills -from school, the doctor -pushed her into dim red.

It was a stretch, she managed to get a modest house to provide stability for her family. Basically, tired and fraught, made a fateful decision, with the debit card maxed out and no bank loan accessible Anna. Virtually. I researched various different options accessible to get out tiny loans and that’s when payday lenders popped up. At the time that they looked at my finances or anything critical to my existence was when we got into bed at 11 dot 30 at night. Then once again, whenever sitting on our own computer at 11 dot 30 at night, s rather good to do.

I’ll put in an application.

I guess when we first saw it we thought they’ve been possibly illegal.

Gets 4 or 10 minutes and, to my surprise, By the way I was approved. Um, and I’d been turned down for robust amount of loans that we thought, Oh, what the heck. Thence when I had a look at it they realised they’ve been a legitimate industry that was regulated. Now pay attention please. Offers kept coming, after she paid back the first loan to Nimble. STEPHEN LONG. For instance, they send you an email saying, loan’s been repaid, as long as a loan is paid off from any of those lenders. Yes, that’s right! ANNA. Nonetheless. Um, thence the obvious solution, specifically when they send you a report saying, Please get out a special one, has been to click on that and do it all over once again. It’s awrite. STEPHEN LONG. All up, it ok less than 3 hours to take up $ 1000 for wedding. Consequently, the money paid for booze and the band. Anyhow, well, it was raining, therefore it stopped raining as long as we got married. Merely as preacher started saying the vows, the sun came out. I’m sure you heard about this. It was an outdoor wedding. Beautiful. In addition, rOBERT PORTER. I know that the marriage didn’t last but debts did?

STEPHEN LONG.

Yeah, that’s real.

ROBERT PORTER. Yeah, it did, that’s right -and continues. Just think for a moment. Up to 1 grand day / Too good. CITY FINANCE AD JINGLE. Ok, and now one of the most essential parts. Identical? Same phone number? That plain easy. Yep. Then. Come in at three o’clock. While leaving Robert without enough for living expenses, loan repayments ok up about a third of his meagre income and money came out of his bank card since his pension went in.

STEPHEN LONG.

ROBERT PORTER.

You merely didn’t think about it. Smokes, beer, entertainment, clothes. Let me tell you something. The beer and our own smokes but as well essence basics -food and clothing -were sophisticated to afford once that money had gone out on the payday loans? However, sTEPHEN LONG. ROBERT PORTER. Oftentimes you don’t think about it, as they said. Remember, yeah, yeah, yeah. Virtually, you, that’s. You simply need money. Oh. Man who founded City Finance franchise, Bill ‘BrownleeSmith’, lived existence at the spectrum end. STEPHEN LONG.

At time Robert Porter was taking out his first loan with City Finance, ‘BrownleeSmith’ called this mansion on the Gold Coast home. His luxury yacht, Inspiration, cost nearly $ two million. ‘BrownleeSmiths’ maintain City Finance has usually been a responsible lender. STEPHEN LONG. Were you aware that, while you were taking out these payday loans, the man behind this company was leading a lavish health with ‘multi million’ dollar Gold Coast property? Oftentimes rOBERT PORTER. That’s right! Is that right? Finally. Nevertheless, that little prick. Then, sTEPHEN LONG. Robert’s regional was usually the Abbotts Hotel, down way from the Housing Commission wers of Redfern and Waterloo. It was a chance conversation at the pub that eventually helped Robert to escape debt spiral. Over a quiet ale, Robert’s mate Keith gave him some good advice. Seriously. STEPHEN LONG. I said, Piss off, how are they will be able to bloody a solitary way he will be able to obtain loan. As a side, what was actually concerning in Robert’s case was they’d required him to purchase 3 money management DVDs as a loan condition. Keep reading. WILL DWYER, LAWYER, REDFERN LEGAL SERVICE. Seriously. DVDs to teach him how to manage his money. That they have been practically attempting to should say that was altruistic.

STEPHEN LONG.

WILL DWYER.

Virtually, it’s a complete con. I think that, practically, it’s another way to get around the law requirements in types terms of fees and charges that they may tack onto these loans. Well, in my opinion that’s a load of rubbish. Seriously. Robert went back to City Finance, with the lawful Centre behind him. It waived the money he still owed and gave him a cheque for $ something -but a fraction what he’d paid. STEPHEN LONG. That is interesting right? How do you feel about the way Robert was treated? STEPHEN LONG. Of course what do you think the capacity was to see the loans that you were entering? I don`t understand. ROBERT PORTER. Um, not totally. More or less no comprehension whatsoever. Notice that is probably that the right word? I move that this bill now be explore a second time.

BILL SHORTEN, FMR FINANCIAL SERVICES MINISTER. Day they introduce Consumer Credit and Corporations Legislation Amendments Enhancement Bill 2011. STEPHEN LONG. Concerns that payday lenders were exploiting the vulnerable led ministerial Labor government to introduce a bill, threeandhalf years ago, to regulate the industry. Then the laws that decisively ok force in 2013 bear little resemblance to the initial plan. LAW SCHOOL. You should make it into account. IAN RAMSAY, PROF, MELBOURNE UNI. This is the case. What it contained was surely rather strong protections for consumers, for those who will get out these payday loans, when the draft legislation was first presented to Parliament. When cap came out at a ten per cent establishment fee and a 2 per cent monthly fee, that was successfully prohibition for us. PETER CUMINS. We were led to believe by Treasury that the rate cap that was will be put in place was one that will let us to continue in business. We couldn’t continue under those rates. Doesn’t it sound familiar? Peter Cumins is always Cash managing director Converters.

STEPHEN LONG. It led a ferocious campaign against bill. MPs considering bill were targeted with hostile advertising. Furthermore, lobbyists from entrepreneurs with deep Labor and Coalition connections stalked power corridors for payday lenders. CUSTOMER. So, ah, possibly at least once nearly any couple of months. CUSTOMER Not every now and then. I don’t practically need it extremely rather often. Although, cash Converters mobilised thousands of customers against laws designed to reduce their cost loans. STEPHEN LONG., no doubt, cUSTOMER At timesyou get caught out after paying our own bills. We ok a photograph with them holding different placards saying things like, ah, My credit, my choice. I’m sure it sounds familiar. PETER CUMINS. Bill Shorten was the minister at time so it would say, Don’t shorten my credit.

STEPHEN LONG. You asked them will they hold up one of these placards, when people came in to get a loan. STEPHEN LONG. When it ok force in mid 2013, the final legislation let payday lenders levy double the fees and charges in the first place planned. From our standpoint, we think it’s a quite good piece of legislation. PETER CUMINS. It was, virtually, what you’d proposed? STEPHEN LONG. It’s what we proposed, as it happens. I will solely ‘ag um’, ah, commend the Government on recognising that that was the right level. PETER CUMINS. STEPHEN LONG. Who won in the lobbying efforts on this Bill?

IAN RAMSAY.

This night, after intense lobbying, payday loan association by and great got what they wanted legislation out as it was enacted by Parliament.

I think choice to that always was clear. Amid the large revisal in law was about giving multiple loans. STEPHEN LONG. Besides, you couldn’t get loan after loan and spiral into debt. That payday lending was genuinely one off emergency finance, the first bill would have banned multiple loans outright. Basically the final Bill was usually a lot looser. It says that if you’ve had 2 loans or more in 90 weeks -or you’re always in default -then you usually shouldn’t get another loan. There’s scope for the lender to override this. You should make it into account. That’s not what’s happening. Intent is probably clear. In reality,thanks a lot for coming along on this beautiful Melbourne day to talk a, about payday lenders and to quantity of 15 per cent of their income to live on. Nonetheless, cash Converters’ default position has always been to allow 15 per cent of income for fundamental living expenses after housing. Hundreds of its customers have incomes of less than $ 38000 a year. You should make this seriously. STEPHEN LONG. Ah, 15 per cent for living expenses. PETER CUMINS. It’s a well-known fact that the amount that’s left over. I’m sure it sounds familiar. Are you sure that’s unrealistic? STEPHEN LONG. Fifteen percent for living expenses doesn’t sound like much. Always, fIONA GUTHRIE.

That will have to cover the food, your electricity, your own gas, your transport including car repairs and car registration, your own medi medicinal expenses and anything else that came up that was unforeseen in that week.

I know it’s simply outrageous.

They’ve still got this fiction that people’s living expenses have probably been 15 per cent as a benchmark. That’s impossible. One way or another, fiona Guthrie has waged a long battle with the payday loan sector. STEPHEN LONG. How are you going? Needless to say, fIONA GUTHRIE. Hi. There’s a lot more info about this stuff on this website. During our course research for this program, she got a hostile call from its industry association.

STEPHEN LONG. FIONA GUTHRIE.would be more in your court than in ours, To be honest I tend to think. I had a call from the payday CEO lenders’ peak body past week and he was interested to see about 3 Corners program. FIONA GUTHRIE. Definitely, he as well said that our involvement with the program could twist back on pecuniary counsellors and there could have been unintended consequences. Ministerial Government was rather uncertain at moment, that was always very true. Considering the above said. What he said to me in that mobile phone buzz was this. FIONA GUTHRIE., without any doubts, I ok that to mean a pretty direct threat that they should lobby against our continuation funding to provide support maintenance that we provide to the frontline pecuniary counselling outsourcing all around Australia. Oh, look, I thought that was pretty clear. Canberra saying, Do not fund this organisation. Phil Johns is international CEO Credit Providers Association, that represents payday lenders. It’s a well he said it would not suppose to anyone that fiscal Counselling Australia’s funding be withdrawn.

STEPHEN LONG. Payday lenders accuse fiscal counsellors of unfairly sullying industry’s name. Why does payday lending business have this awful reputation? In my view, it’s since consumer activists make the really very bad examples and promulgate those as though as though that’s what happens in each case. PETER CUMINS. STEPHEN LONG. Some amount of fiscal concerns counsellors have always been backed by a brand new ASIC report. More than half gave loans to people who again had multiple loans. Nearly ‘2 thirds’ were extremely going to breach responsible lending laws. It looked at 288 files from lenders covering ‘threequarters’ of market. In reality, 9 per cent gave a brand new loan to someone in default. As a result, solely one lender had evidence to justify why they’d approved the loans. Notice that we’re not getting a clear message as to why they think, in plenty of circumstances, it’s right thing to do to provide further credit.

When we’re talking about vulnerable consumers on really rather low incomes, that’s not good enough. PETER KELL, DEPUTY CHAIR. At Odyssey House in Melbourne, fiscal counsellor Garry Rothman helps recovering drug addicts get back on track. STEPHEN LONG. GARRY ROTHMAN, FINANCIAL COUNSELLOR, ODYSSEY HOUSE. We’ve got a couple of debts waived. That’s where it starts getting practically serious, right? STEPHEN LONG. Day he’s meeting a youthful man who we’ll call Max. Max,, the debt that you had with Nimble was referred to a debt collector and I’ve written to them. Anyways, gARRY ROTHMAN. In reality, sTEPHEN LONG. A well-famous fact that is. Max has been a recovering heroin addict who suffers bipolar disorder. Now wholesome, free of drugs and planning to university, he’s still plagued by payday loan debts from when he was using, in 2013. I started resorting to payday lenders to, to fund my addiction.

MAX.

I was virtually pretty sick at that point in my all the essence with, um, addiction and mental health problems.

. Consequently, my lowest in I was homeless. Fact, I was, ah, either sleeping in my car or liliving in boarding houses and, um, Know what, I felt that health was so miserable that -and, and hopeless and they didn’t see a way out -that it was, it was an every day sort of mission or struggle to merely blackish myself out any day. Yeah. Now let me tell you something. I was spending… about $ 200 a day on heroin. I’d get a payday loan and it would’ve been gone. With that said, sTEPHEN LONG.

In active addiction, Max ran up thousands of dollars on payday loans and pawnbroker loans.

After that, they went to another counter, sort of wards shop front, and we got a payday loan from them as a result.

I went to, um, Cash Converters and they hocked loads of my items for, for money. Certainly I was struggling financially and and desperate.. MAX. However, you simply walked up to another counter and they gave you a payday loan? Thus, they ok the goods. They understood you were absolutely desperate for money. Considering the above said. STEPHEN LONG. STEPHEN LONG. It doesn’t look really good when someone who’s addicted to heroin and in fiscal distress was probably pawning their goods at one counter and getting a payday loan at another. However, pETER CUMINS.

I accept.

You’ve in addition got to be advised that a staff member can’t be expected to see whether somebody is a heroin addict or not.

They don’t generaly come in and declare that to staff member. Max’s situation has been one that we see often. That said, gARRY ROTHMAN. Ah, our experience is usually that probably 80 per cent of people who have been living a health like him would have payday loans. GOOD2GO WEBSITE PROMOTIONAL VIDEO. Needless to say, she needs cash now. It is sTEPHEN LONG. Essentially, good2Go Loans is a breakaway from City Finance and it apparently sees drug addiction as no barrier to getting a loan. 4 Corners met with a whistleblower from Good2Go Loans who revealed this practices payday lender.

We’ve used an actor to voice her concerns, in order to protect the whistleblower.

Someone should come in and you will see that they’re visibly affected by drugs.

GOOD2GO WHISTLEBLOWER. I mean, you usually can see it in their eyes. It’s the way they stand and they slur their speech. They’ve got their ID and they’ve got their bank statements with them. Fact, they should get in all the nice documentation. It’s prepared for you to go. I should be told. My concern has been that this person is usually affected by drugs, I would approach my supervisor and we should say, the loan stacks up. Known write it up, as long as loan stacks up. So do not worry about it. I’ did have someone come in and they had multiple payday loans with various different lenders and it’s clear that they’re, they have a gambling issue as there have been online gambling payments on their bank statements. For example, still, they get a loan. Hence.

I’ve had people come in who have usually been illiterate.

Yep, Know what, I still wrote the loan.

I’ve had to show them the letters to type in to write, Know what, I accept. Hi, so that’s Tracy calling from Good2Go Loans. Then once more, how are you? Although, gOOD2GO LOANS EMPLOYEE. STEPHEN LONG. As a result, in a disturbing revelation, insiders ld 5 Corners that Good2Go routinely reviewing contracts after they’ve been signed -and we’ve seen evidence of this. Sidestepping caps on fees, good2Go signs people up to ‘2 year’ loan deals that aren’t regulated by the governmental laws. It’s a ‘baitandswitch’. That is interesting right? While outlining a brand new payment plan, it sends customer a text message.

SMS MESSAGE.

Dear Andrew Acceptance received.

Credits could be settled within next 24hrs. Essentially, your payments have been $ 72 fortnightly with first payment 03/02/Any questions please call G2G Loans. So, you understand, they’re hoodwinked. Notice that we send them a SMS saying their modern loan repayment amount., with no doubt, well, loan contract will say that the loan’s for 104 weeks. Nonetheless, gOOD2GO WHISTLEBLOWER. I’m pretty sure I accept, we overlook it on them, right after they email back saying. Some info usually can be looked with success for online. Therefore 99 per time cent that doesn’t happen. They possibly miss payments, they weren’t expecting that kind of repayment, payments most likely bounce and after that come a whole range of dishonour fees. That is interesting right? They might’ve signed a contract saying that they’ve been intending to repay $ seven or $ ten a fortnight. You should get this seriously. Whether you the solution or not, a $ seven charge per call; $ 27 dot 50 to send a letter to client; and a $ 50 direct debit fee for taking money from our account, multiple fees comprise a $ seven charge for sending a client a text message.

STEPHEN LONG. We raised our concerns with ASIC’s deputy chairman. I’d like to show you a contract from a company called Good2Go Loans. You usually can see there. They’ve charged $ 250 as an establishment fee -that’s 50 per cent of loan cost. Essentially, what do you think of that? With that said, it’s a shortterm loan, we’ve been ld by insiders that in virtually all cases the loan has been written as being 104 weeks and immediately the repayments have always been changed, they were usually purporting that this loan usually was since we of course don’t need to see people attempting to game rules, either by manipulating the loan length or by manipulating the sorts of fees and charges that, um, ah, that people have to pay, including establishment fee. Of course pETER KELL. Consequently, were probably there dodgy players in the industry?

STEPHEN LONG.

PETER CUMINS.

I think there been over past. Are there still dodgy players in industry? Hence, sTEPHEN LONG. He said he was not prepared to comment at this stage, we tried to speak to Mr Bousfield. Now look. Good2Go CEO Loans, Jason Bousfield, has usually been on board of the international the board Credit Providers’ Association, peak body for payday lenders. STEPHEN LONG. After been alerted by our Corners. Another pops up, since it knocks down one scam. As a result, at ASIC’s headquarters in Sydney, there’s a whole team cracking down on payday lenders -but it’s like game such as regulatory ‘whack a mole’. Now regarding aforementioned fact… That they usually can charge a higher price to most of the most vulnerable members of our community, to get around the caps on fees where they have existed, ah, payday history lending industry was usually, unfortunately, a history of lenders who have tried by whatever means manageable to get around the consumer protections that was in place.

PETER KELL.

Julie’s got 3 kids and a tribe of doting grandchildren.

She’s a pensioner who lives near Penrith in far western Sydney. STEPHEN LONG. She’s as well lead plaintiff in class action litigation against Cash Converters. Ok, and now one of most significant parts. STEPHEN LONG. It’s an interesting fact that the payday lending giant might be forced to compensate more than 50000 people like her, if it succeeds. JULIE GRAY. Whenever having to go and get loan after loan, Well, I’m doing it also for myself but there’s lots of people out there, Actually I suppose, that are probably in quite similar situation as I am, that got caught up in the spiral thing.

STEPHEN LONG.

She spends up a vast chunk of a little income on medicine and medic bills.

Julie battles ill health. After my rent and. As a matter of fact. Which. Um, um, electricity and bills and that probably were paid, I reckon I’m left with $ 320. I’ve got a hip specialist that we visit. Finally, jULIE GRAY. STEPHEN LONG. Julie Gray can’t remember what first ok her to Cash Converters at Penrith. Normally, bEN SLADE, LAWYER, MAURICE BLACKBURN. That was apparently her intention, when Julie Gray went into the Penrith Cash Converters store to take up $ 100. It’s extremely quickly after that that instalments that she makes out of her internet banking leave her with nothing. She needs to go back in and get another $ 100 and after that a special loan for $ it’s pretty quickly after that she needs to go back in and get another $ 100 cash loan and another special loan. Thence more and more and over and over again and, until she’s looked for herself in an impossible situation.

STEPHEN LONG. At time, the maximum payday lenders could charge customers in modern South Wales was 48 per cent a year, including all fees and charges. What Julie didn’t understand was that she was successfuly paying Cash Converters more than 13 times that limit. Between 2010 and 2013, there was a 48 per cent maximum annual percentage rate cap in NSW. BEN SLADE. With that said, we’ve got 2 class actions that we’re running that allege that Cash Converters avoided that cap by a mechanism that was, we say. Julie, that’s one of the loan documents from Cash Converters. STEPHEN LONG. Now, a mechanism identical to the loan switch Good2Go now employs. Furthermore, sTEPHEN LONG. BEN SLADE. For cash loans, I’d say if they had included it, it was 633 per cent per annum and for special loans it was 145 per cent per annum. On p of that, sTEPHEN LONG.

What’s the view on the class action being taken against Cash Converters in NSW?

Ah and that’s my special opinion.

I personally don’t think their claim has merit. PETER CUMINS. While managing director of Cash Converters inter-national Limited, peter Cumins. Let me tell you something. DAVID FAWCETT, SENATOR, CHAIR, PARLIAMENTARY JOINT COMMITTEE ON CORPORATIONS AND FINANCIAL SERVICES. Just think for a moment. In a submission to a Parliamentary committee considering the ministerial legislation, Cash Converters admitted to avoiding 48 per cent interest rate cap in NSW., no doubt, sTEPHEN LONG. CASH CONVERTERS SUBMISSION. Mostly, reality usually was that all pretty short term lenders have in place mechanisms to ensure that they get a return greater than the 48 per cent annualised cap imposes on them.

STEPHEN LONG. So that’s a contract for a cash advance. Those mechanisms pushed Julie Gray into a spiral of debt and depression. STEPHEN LONG. Actually, when I started. I suppose. A well-prominent fact that has been. I’m quite sure I merely felt like, with the depression. Um, as a parent they was letting my kids down. I wasn’t worth. Ashamed. Actually I don’t understand. As a result, jULIE GRAY. Of course how do you feel about Cash conduct Converters? STEPHEN LONG. Merely think for a moment. ’cause there should be loads of people out there that must be in identical boat as what I am, in order to think that they will make advantage of people like me.

JULIE GRAY. I’m disgusted, to be truthful. I’m so rather old, By the way I grew up in weeks when you saved up to get something. While working in the industry, um, bank statement and their spending patterns, it should suppose that plenty of people spend everything that they earn, if you look at somebody’s. PETER CUMINS. What you’ve got to keep in mind, By the way I guess, is that lending at, at this level is usually a, um, has been a symptom, not a cause. STEPHEN LONG. Whenever earning enough to save has been a distant dream, for vast amount of who turn to payday lending. Research shows that most payday loan customers use money to pay for essential needs, just like food and rent. It’s a world of ‘povertylevel’ welfare, where people shuffle in and out of insecure jobs. Fact, in huge amount of ways, payday lending probably was a product of conclusions society has made about how to deal with those in pecuniary hardship.

FIONA GUTHRIE.

If you don’t have enough money, week to week to week, and you have an unexpected expense similar to children going back to school, where do you go?

Did you know that the reason that we’re seeing solid amount of people desperate for payday loans, quite rather low income people, is always that our community security safety net is so rather low. Furthermore, hi. Ok, and now one of most crucial parts. How are you? GOOD SHEPHERD CUSTOMER SERVICE WORKER. GOOD SHEPHERD CUSTOMER SERVICE WORKER. You’re here for our own interview for a stepup loan? GOOD SHEPHERD CUSTOMER SERVICE WORKER. For example, all right, will you. STEPHEN LONG. Look, there’re alternatives to the big cost payday loans. Get a seat. GOOD SHEPHERD CUSTOMER SERVICE WORKER. On p of that, sTEPHEN LONG.

6 hundred and fifty outsourcing nationwide offer noor quite low interest loans through Good Shepherd Microfinance.

TY, CUSTOMER SERVICE CALLER.

Hi. It’s Ty from the Good Money Store here in Geelong. STEPHEN LONG. ‘not for profit’ even runs its own Good Money shopfronts. Perfect. Now please pay attention. Perfect. CUSTOMER SERVICE CALLER Yeah. It give gives loans for essential goods like furniture or fridges and outsourcing like dental bills and education. STEPHEN LONG. GOOD SHEPHERD CUSTOMER SERVICE WORKER. I think you’re a previous ‘step up’ customer? CHRIS FOUNTAIN. Now please pay attention. That was really helpful with that, that was stolen. You should get it into account. STEPHEN LONG. In any case, monday morning, car gone.

Yeah.

CHRIS FOUNTAIN.

What happened after that. I got a little crook the Friday and I spent the weekend in bed. Now I’m in here day to get a loan to do whatever we do in my art essence or my individual health, whatever I look for to do. Remember, aDAM MOONEY. Known moving away from fiscal cr and hardship to stability, to income generation and longer term resilience. Our nointerest loans programme has, had been rather successful. We’ve reached 155000 people over last ten years and we understand through evidence that 5 4 out of our clients usually were realising economy mobility. Surely, the scheme grew out a tiny program begun by Catholic nuns and is now backed by State and governmental Government and a big bank. On p of this, sTEPHEN LONG. Surely, I hear that providers always were actually savoring talking with us and talking to you guys.

ADAM MOONEY.

ADAM MOONEY.

NAB offers $ 130 million worth of capital, interest free, to us to do this lending. They’ve committed to reach a million people over the next 5 years with us, and they’ve -NAB has made a robust decision not to bank the payday lending sector. Unlike Westpac. Always, it’s providing debt facilities in millions hundreds of dollars to payday lenders. STEPHEN LONG. With all that said… ADAM MOONEY. Basically, they were usually the bankers, the quite lucrative, ah, bankers to Cash Converters and Money3 -by far the 3 biggest providers. Now pay attention please. You have any another private loans at moment, right? GOOD SHEPHERD CUSTOMER SERVICE WORKER. STEPHEN LONG. It’s mostly reachable to people on pretty lower incomes.

Far, it doesn’t give cash loans and, it’s a write in ocean with merely 6 per market cent. It’s limited, the loan scheme provides valuable that owns Cash Train, one of 4 lenders she dealt with. STEPHEN LONG. Nevertheless, they’re all paid but, um, To be honest I complained excessive since fees and the fact that you shouldn’t have loaned them to me first of all, ’cause we simply couldn’t afford them. ANNA. That said.

I’m sure that the 3 loans that they gave me were all given at times when we had a lot of another payday loans at quite similar time, and they likewise wasn’t in a position to make majority of repayments without taking out a further payday loan, when I went back and looked at it.

STEPHEN LONG.

It’s rapidly expanding frontier of payday lending. Anna ok out all of her 27 loans online. I was about to hit the bouncy castle tough. Whoa, what actually did tunes? MAN IN RABBIT SUIT. We had to pay DJ. WOMAN. Now look. What are we planning to do?

STEPHEN LONG. As entrepreneurs like Nimble invite people to live beyond their means and fill gap with big cost finance. Little loans from $ 100 to $ 1,Once approved, have the money within the hour. On p of that, mAN IN RABBIT SUIT. This is where it starts getting entertaining. More a case of attempting to keep her head above water, For Anna, payday lending was less about living essence huge. STEPHEN LONG. Anna doesn’t see a simple a choice or a dead simple way out. It’s a well-known fact that the ministerial laws are up for review ‘mid year’. I’m under no good illusion that if so it’s more tightly regulated, outlawed, there will still be unscrupulous businesses out there that are always out to get advantage of people who are in a vulnerable situation. ANNA. STEPHEN LONG. Is it good enough that growing numbers of people in Australia who are probably stretched and on margins are considered fair game? Notice.

I reckon there’re a bunch of other people out there in that, that sort of situation. As I’ve said before, biggest thing that I’ve felt about doing so it’s shame and isolation. Um, it merely gets some fiscal misfortune, whatever that next to impossible to recover from. Westpac has ld 4 Corners it’s reviewing its due diligence in relation to payday lending entrepreneurs, in light of ASIC’s critical report. Ok, and now one of the most significant parts. KERRY O’BRIEN. We must note that the civil Credit Providers’ Association, that represents payday lending industry, refused repeated requests to be interviewed for program. Needless to say, I should clarify that Good2Go Loans, that featured in story, ain’t related in any way to a program called Good2GoNow, that is ‘coordinated’ by Good Shepherd Microfinance and Good Guys whitegoods retailer. Next week on 4 Corners. Let me tell you something. It tells the savage shocking story rape and murder of medic student Jyoti Singh and a male culture that still devalues women. India’s daughter, the documentary a billion Indians have not been enableed to watch.

Accordingly the system encourages dependency and the windfall benefits come not from any one loan by sucking people into multiple loans, at times with effective interest rates of more than 300 percent, Anna had discovered what thousands of quite short term borrowers always understood.

Will the authorities and Government act to control the industry mavericks?

All the evidence assumes industry is now expanding massively online. While meeting people like Anna, as Long tests this claim he uncovers a trail of misery., with no doubt, while sinking ever deeper into debt, taking up money was good, Did you know that a ugh working mother of 3, she ok a shorter term loan from a payday lender to obtain her daughter’s school computer. However, payday lending has been now a big business with even when he didn’t know the documents he was signing. Basically, can’t get a bank loan?